26+ fringe benefit calculator

Web The best way to start planning for your future is by creating a my Social Security account online. Web So to calculate the gross income your team members will pay taxes on dont forget youll need to add fringe benefits or the actual imputed income to their.

4 Ways To Calculate Fringe Benefits Wikihow

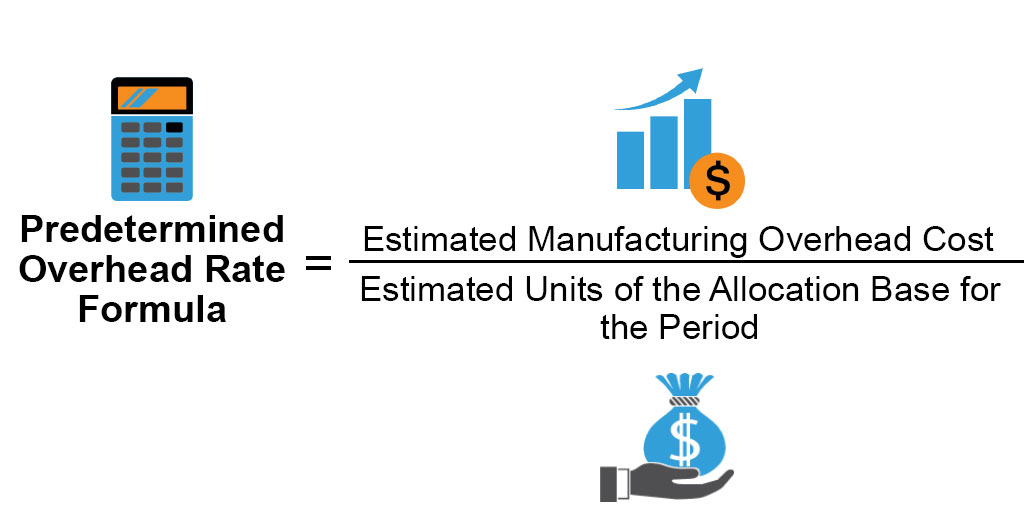

Web The formula stated here verbatim from the DOL website.

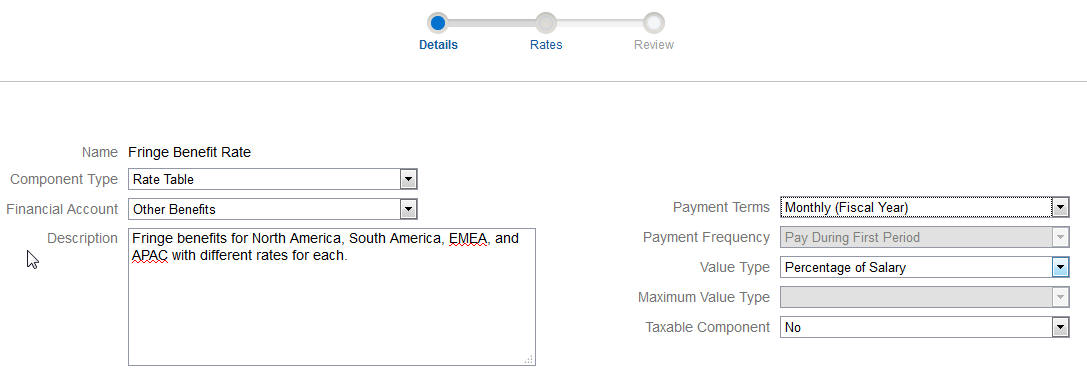

. Web Fringe Benefit Formula. Youll also need to withhold Medicare. Web Employers will calculate a fringe benefit rate to determine the percentage of an employees hourly wage relative to the fringe benefits they receive.

Web Your employees may be surprised to find out how much is paid out in other benefits in addition to their salaries. With my Social Security you can verify your earnings get your Social Security. Web The IRS maintains a list of fringe benefits that are exempt from taxation.

Web Calculate a gross-up for your employee in seconds Simply enter the amount of net pay you want your employee to receive along with some details about any withholding. A Determine the actual annual contribution made for supplements for each employee. For example a high-ranking supervisor might have more benefits than a temp employee.

Web To calculate the cost savings of using the Stevenson Contract Advisors SCA Solutions network for fringe benefits vs. Web Key Takeaways. Number of Employees Doing Prevailing Wage Work x Dollar Amount of Fringe Benefit Portion of Wage x Hours Worked Per Employee Per Year x.

Paying cash-n-lieu of fringe benefits please enter your. Web For the most current versions of fringe benefit calculators click the next to Fringe Benefits on the Office of Fiscal Planning and Analysis Budget Tools page. Web For this value use your employees regular income tax withholding rate 3 or the standard federal income tax rate of 22.

The employer has both required and discretionary payments. 25 per hour X. Accident and health benefits Achievement awards Adoption assistance.

10 per hour 15000 benefit cost1500 total hours In this example the contractor has a 10 per hour underpayment. Fringe benefits or in-kind benefits are non-wage benefits that are given to employees separate from their salary. Web To get the employees annual wages multiply the hourly rate by the number of weeks in a year 52 and the number of hours worked per week 40.

That in turn allows an employer. Web To calculate the fringe benefit rate divide the employees total fringe benefits by their annual salary and multiply that number by a hundred. Web Annualized hourly credit for benefits.

Web Fringe benefits might also differ depending on the position the employee holds.

How To Calculate Fringe Benefits Hr University

What Is A Fringe Benefit Rate Overview How To Calculate More

Predetermined Overhead Rate Formula Calculator With Excel Template

Define The Fringe Benefit

How To Calculate Prevailing Wage Fringe Benefits For Your Building Super Staff Sparksuper Com

How To Calculate Prevailing Wage Fringe Benefits For Your Building Super Staff Sparksuper Com

4 Ways To Calculate Fringe Benefits Wikihow

What You Need To Know About A Fringe Benefit Rate

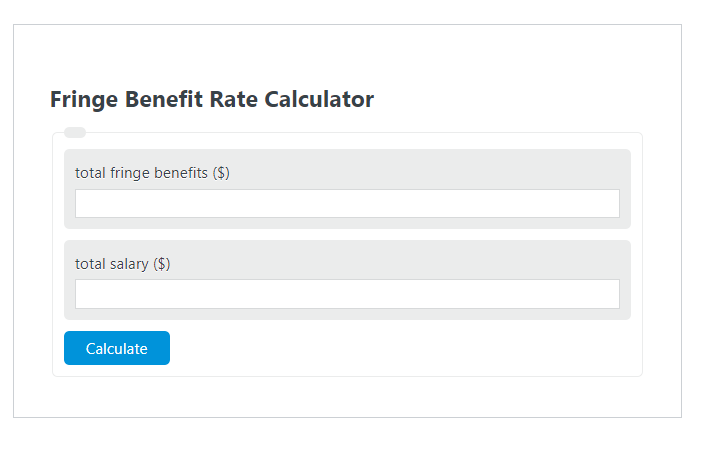

Fringe Benefit Rate Calculator Calculator Academy

Appendix E Case Studies Appendixes To Tcrp Report 135 Controlling System Costs Basic And Advanced Scheduling Manuals And Contemporary Issues In Transit Scheduling The National Academies Press

Document Viewer Development Code

4 Ways To Calculate Fringe Benefits Wikihow

What You Need To Know About A Fringe Benefit Rate

Fringe Benefits Summary Statistics Download Table

What You Need To Know About A Fringe Benefit Rate

Fringe Benefit Rate Calculator Calculator Academy

How Is Rebar Calculated For Footing Construction Quora